Common Payroll Error Messages

This article shows a number of common errors that appear during payroll processing and outlines ways to fix the underlying issues.

OVERVIEW

Errors and warnings received during payroll processing can be triggered by a number of factors. Some of them may hinder your ability to process payroll, while others are simply warnings that will allow you to process. This article explains what each common error message you might encounter means, and how to resolve it to ensure a successful payroll process.

TIP:

Any messages and alerts that will prevent you from processing payroll flagged with a siren to help you determine whether or not it requires immediate attention.

If you have an error during your payroll process that does not appear here, please reach out to Service via the Help Community. If possible, please include a screenshot of the error message you are receiving.

GENERAL ERRORS

Error: Your payroll transaction (Process ID XX) stalled because there are too many users in your company payroll portal. Please refresh your payroll batch.

This occurs when more than one employee is viewing the same page in the same cycle within payroll processing.

Error: You are missing valid tax id's for X taxes. We will not collect or remit taxes with ID's in an "Applied For" status, but they won't prevent you from running payroll. You can update this information on the Company Tax Page.

Taxes are in Applied For status.

Error: There are [#] employees in the pay cycle that need to be manually prorated. Use the manual proration status in the filters dropdown to see who they are.

We do not offer proration for hourly employees at this time. Please manually prorate the hourly employees if necessary.

Error: Conversion from string "" to type 'integer' is not valid.

A dollar sign or a non-numeric character was entered in a number field. Please remove the character from the field.

Error: Error validating totals between PayCycleWage and PayCycleTS1Wage.

A change was made to an employee's TaxEmployeeTypeID on the employee level after opening a pay cycle. Remove and re-add the employee.

Error: Error deleting records from PayCycleTotal table.

An Additional Pay amount of $0 was uploaded. Remove the approval for the $0.00 additional pay amount via Payroll Center > Approve Additional Pay/Expense.

MISSING/INCOMPLETE INFORMATION ERRORS

Error: Taxes in Applied For status.

The State SUI on employee tax does not match the employee's live-in or work-in state.

Error: [#] employees are missing information on their HCM profiles. Review the missing information on the Profile Status page and correct it or [#] Incomplete profile found. Please review on the Profile Status page prior to running your payroll.

The employee HRIS profiles are incomplete (missing banking, SSN, salary, etc.)

Error: Employee doesn't have an active banking record.

The employee does not have a direct deposit or check information set up.

Error: Employee address is not valid.

The employee's address is not valid per United States Postal Service.

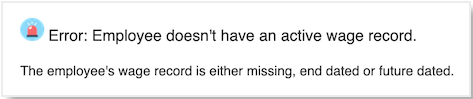

Error: Employee doesn't have an active wage record.

The employee's wage record is either missing, end dated or future dated.

Error: You have [#] employees with no hours in this payroll.

There are hourly employees with 0 hours.

Error: Unable to approve payroll for the highlighted employee(s) due to insufficient taxable wages.

Employee deductions are more than the current pay.

Error: You need to set up company bank information prior to running your payroll. Please add account information on the Bank page.

The company bank information is missing in Namely Payroll.

Error: We found tax setup errors that you can correct on the Company Tax page. This information is required for tax remittance, but will not prevent you from processing payroll.

The company tax setup information is missing in Namely Payroll.

Error: Unable to calculate payroll due to Errors occurred in tax calculation.

An employee is missing a state filing status. Search by Employee ID to identify the employee in the error and add the appropriate state filing status in Step 2 of payroll or on the employee's profile.

Error: No Data Received. Please check Namely for any structure changes.

Generally occurs when your Namely URL has been updated. Submit a case in the Help Community for investigation and resolution.

-

Product Name: Payroll

-

Product Feature: Payroll Processing

-

Function: Payroll Processing Step 1, 2, or 3 (depending on which step you encounter the error)

Error: Exception has been thrown by the target of an invocation.

Generally occurs when an employee is attempting to enroll in benefits. Solutions may vary depending on the circumstances, but these items should be reviewed to troubleshoot:

-

The employee's demographic start date does not match their hire date, or there is a gap in the employee's demographic records. Ensure the employee has a demographic record that covers their entire tenure in the organization.

-

The employee's Tax information is incomplete. Go to their Tax page and update. If the tax information looks correct, select Edit > Save.

-

If multiple employees are receiving the same error, there may be an issue with a Benefits Rule. A case should be submitted in the Namely Help Community for investigation and resolution.

-

Product Name: Payroll

-

Product Feature: Payroll Processing

-

Function: Payroll Processing Step 1, 2, or 3 (depending on which step you encounter the error)

-

Error: Are you sure you want to approve this pay cycle?

Please note that you have tax reporting errors that could result in late payments to certain tax agencies. Namely is not responsible for any penalties or fees related to tax notices if these errors are not corrected.

You will receive this error if you have an Invalid Tax. You'll have the option to process payroll with the error - the system will allow you to check a box next to a statement "I understand the impact of tax reporting errors. If you check the box, you can approve payroll with the error. You can resolve the issue by going to Company > Tax and applying the Invalid Tax filter to determine what items have issues.

REMINDERS

Message: Employee has pending benefit elections.

The employee has outstanding benefit elections that have not been approved.

Message: Do you have any additional wages to import?.

A reminder to import any additional wages if necessary.

Message: You have [#] employees with additional wages.

Any employees with additional wages have been imported.

Message: You have [#] employees that started mid pay period.

These employees have a a start date greater than the payroll start date.

Message: Do you have any deductions to update?

A reminder to update any deductions if necessary.

Message: Do you have any tax filing statuses to adjust?

A reminder to update any employee tax filings if necessary.

Message: Do you have checks printing this cycle?

A reminder to update check printing if necessary.

OTHER ERRORS

Error: We tried to sync some employee information from HCM but there have been validation errors in the process. Please go to Error Log page and review the errors or Some employee information didn’t carry over to payroll. Please go to the Error Log page and review the employee profile errors.

The data entered in HRIS could not sync to Namely Payroll (phone number validation, SSN validation, client job ID, wage errors, etc.)

Error: There was an unexpected error deleting the selected paycheck(s). Please try again. If the issue persists, please submit a case via the Help Community.

Retry and submit a case in the Help Community if the problem persists.

-

Product Name: Payroll

-

Product Feature: Payroll Processing

-

Function: Payroll Processing Step 1, 2, or 3 (depending on which step you encounter the error)

Error: Network Error

Refresh the page and submit a case in the Help Community if the problem persists.

-

Product Name: Payroll

-

Product Feature: Payroll Processing

-

Function: Payroll Processing Step 1, 2, or 3 (depending on which step you encounter the error)

Error: You have [#] employees in remote link.

There are employees that need to be added to Namely Payroll from HRIS.